How Are Sole Proprietorships And Partnerships Alike

A corporation is a legal entity separate from the owners of the business.

How are sole proprietorships and partnerships alike. It has no separate existence apart from the owner. They both offer more limits on liabilities than sole proprietorships and partnerships. The business owner is responsible for the debts and liabilities and the accounting and record keeping methods are usually simple and straightforward.

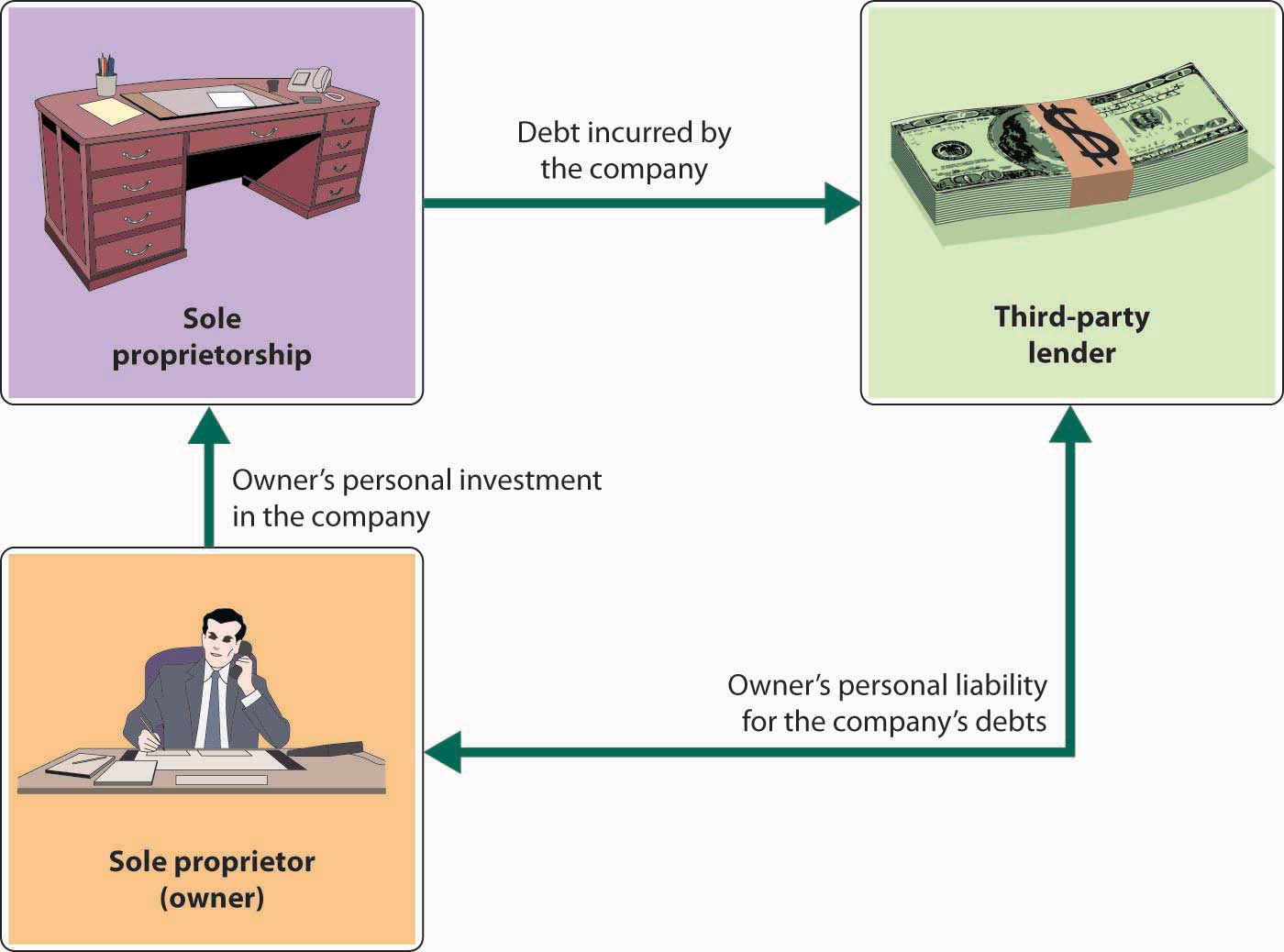

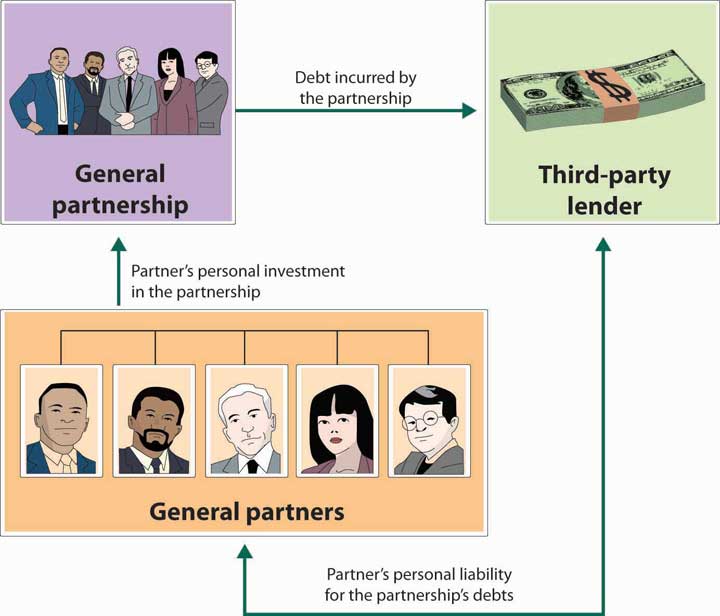

Both sole proprietorships and partnerships place full debt and legal liability onto the shoulders of the. Specifically a sole proprietors or partners assets may be at risk if the business gets sued or takes on debt. With other business structures such as an LLC or corporation.

When you have a partnership you will work with at least one co-owner. A business firm or organization owned by a single person is said to be a sole proprietor whereas a business or an organization owner by two or mo. A sole proprietorship is where the single owner operates the business.

A sole proprietorship is the easiest entity to form because it is not a legal entity and requires no paperwork. They are more complex than sole proprietorships and partnerships. A sole proprietorship is an unincorporated business owned by one single person and often managed by that same person.

You bare the burden of all the risks by starting your business by yourself. Both sole proprietorships and partnerships are unincorporated entities so the individual owners are not considered as separate from their business operation. The major difference between a sole proprietorship and a franchise is that the task name and plan of action have just been resolved when you buy a franchise.

With a sole proprietorship you are the sole owner in some states your spouse may be a co-owner. There are a number of factors to. Sole proprietorships and partnerships are common business entities that are simple for owners to form and maintain.