What Are The Similarities And Differences Between Partnerships And Sole Proprietorships

Income and expenses must be reported in Schedule C Form 1040.

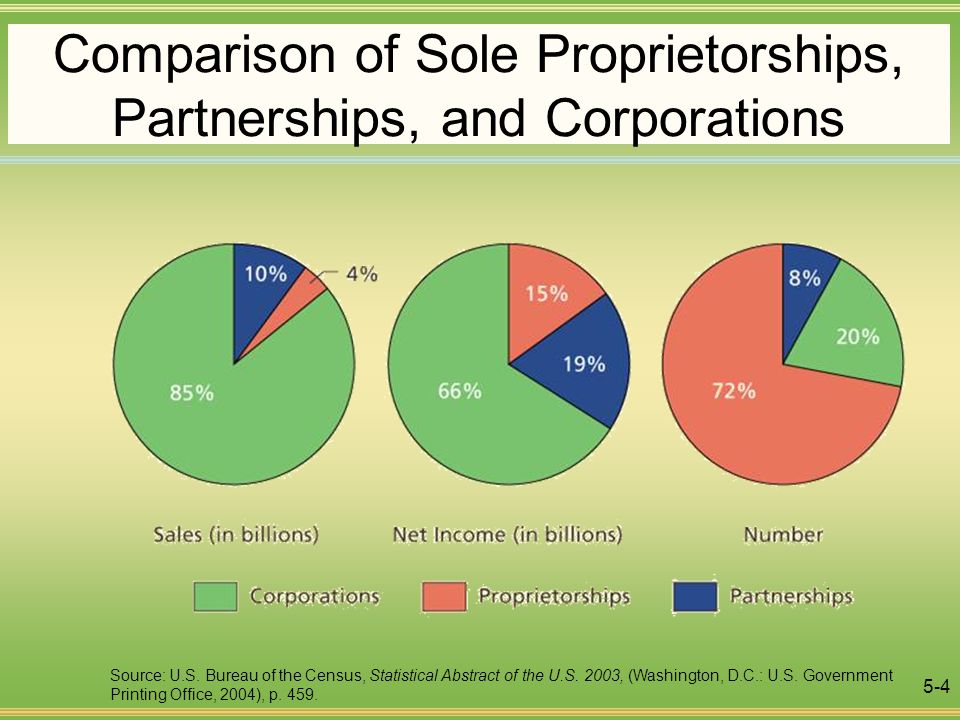

What are the similarities and differences between partnerships and sole proprietorships. Instead the individuals behind sole proprietorships and partnerships and the business entities themselves are legally one and the same. Differences Between Sole Proprietorship Partnership Corporation. The law considers corporations to be entirely separate from the people who operate them but sole proprietorships and partnerships do not involve this kind of separation.

A sole proprietorship contains only one owner whereas a partnership may be made up of a number of individuals. Choosing the right legal structure for your new business is an important decision you must make early in the planning process. Wahaj Awan A sole-proprietorship has one owner who has unlimited liability for the business.

A partnership is similar however it is owned by two or more individuals. One similarity and potential drawback that both sole proprietorships and general partnerships share is personal liability. A sole proprietorship is where the single owner operates the business.

These types of business formations may require minimal formal paperwork prior to commencing operations. Unlike a partnership a sole proprietorship is not a separate entity from its owner. Heres a quick list of the similarities between LLCs and sole proprietorships.

When starting a business choosing which business structure is right for you can be overwhelmingThe five core legal businesses structures are sole proprietorships LLCs partnerships corporations. Similarities Between LLCs and Sole Proprietorships. For example if three people form a general partnership but one partner puts up half of the total capital there could be a 502525 equity split.

In the case of a bankruptcy the sole proprietor is personally liable for any business debt or liability. With a sole proprietorship you are the sole owner in some states your spouse may be a co-owner. Income and expenses must be reported in Schedule C Form 1040.